-

-

Monday, July 28, 2014 from Kiplinger's Personal FinanceAfter many lean years, this fund posts healthy gains.

- Keren Bobker helps resolve a mobile subscriber's difficulties switching to du from Etisalat.

-

Monday, July 28, 2014 from MarketWatch.com - Personal Finance NewsStock trader Mark Cook, winner of the 1992 U.S. Investing Championship, sees a bear market coming within 12 months, writes Michael Sincere.

-

Monday, July 28, 2014 from MarketWatch.com - Personal Finance NewsDebt is not a four-letter word — it’s downright American, writes Jeff Reeves.

-

Monday, July 28, 2014 from MarketWatch.com - Personal Finance NewsLove at first "site" is the goal of automakers' websites, as Arianne Walker of J.D. Powers tells Adrienne Mitchell.

-

Monday, July 28, 2014 from Mortgages & home | This is MoneyThe balance of people who believe the coming year is a good time to buy has plunged from 34 per cent in the first quarter of 2014 to just 5 per cent in the second.

-

Monday, July 28, 2014 from MarketWatch.com - Personal Finance NewsA busy week for economic data, highlighted by jobs; Charlie Turner previews the week ahead

-

Monday, July 28, 2014 from Personal finance news, how to make money, how to save moneySome of savers' most popular funds have underperformed over the past five years

-

Monday, July 28, 2014 from Personal finance news, how to make money, how to save moneySome of savers' most popular funds have underperformed over the past five years

-

Monday, July 28, 2014 from Personal finance news, how to make money, how to save moneyIf you want to start a long-term savings plan for your children or grandchildren, which fund should you buy?

-

Monday, July 28, 2014 from Clever Dude Personal Finance & Money

Image courtesy of Suat Eman / FreeDigitalPhotos.net I had a serious case of sticker shock at a bar in downtown Chicago when a bartender told me that I owed $8.50 for a rum and coke. I’m from a smaller town where I’m used to payi...

Image courtesy of Suat Eman / FreeDigitalPhotos.net I had a serious case of sticker shock at a bar in downtown Chicago when a bartender told me that I owed $8.50 for a rum and coke. I’m from a smaller town where I’m used to payi... -

Monday, July 28, 2014 from Globe Investor - Personal Finance RSS feedThe Globe's Rob Carrick talks to Jim Leech, former CEO of the Ontario Teachers' Pension Plan and author, about our pensions

-

Monday, July 28, 2014 from Wise BreadOne in three adults in a combined financial relationship admits to financially deceiving their partner , according to a recent poll published by the National Endowment for Financial Education. Even worse, 76% admit that financial decepti...

-

Monday, July 28, 2014 from Globe Investor - Personal Finance RSS feedOne of the main benefits of taking part in a class-action is that the plaintiffs do not personally assume the financial risk of the litigation process.

-

Monday, July 28, 2014 from Personal finance news, how to make money, how to save moneyAsk an expert: A reader asks if it possible to invest on behalf of her nephew, as an alternative wedding gift to cash

-

Monday, July 28, 2014 from Personal finance news, how to make money, how to save moneyOur consumer expert deals with another complaint regarding Scottish Power's poor service

-

Monday, July 28, 2014 from Personal finance news, how to make money, how to save moneyA trip to Marrakesh was put on hold for a couple when one of them fell ill before departing. Trying to claim back on insurance with Nationwide proved difficult for the pair

-

Monday, July 28, 2014 from fivecentnickel.com

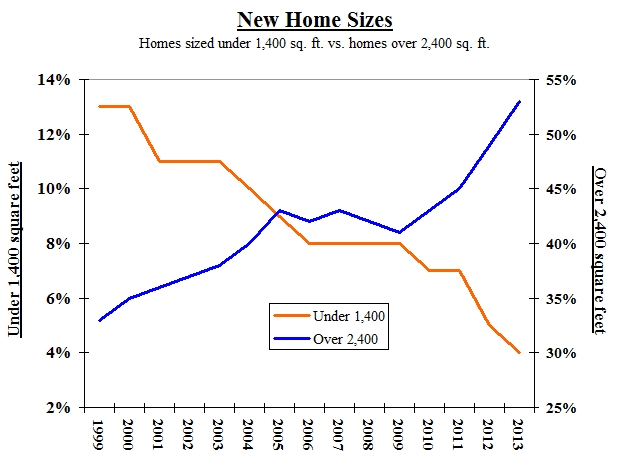

Is there a new movement happening in your backyard that you are unaware of? A new reality television series has probably never been the impetus behind a major change in how we live, but could this one be different? The show in question i...

Is there a new movement happening in your backyard that you are unaware of? A new reality television series has probably never been the impetus behind a major change in how we live, but could this one be different? The show in question i... -

Monday, July 28, 2014 from Mortgages & home | This is MoneyInvestors looking for top buy-to-let yields are better off heading North as returns are stronger, according to a quarterly index from specialists BM Solutions.

-

Monday, July 28, 2014 from My Money Blog

(Update: Walmart’s new automated low price guarantee appears to be nationwide now. While still in “beta”, their FAQ has been scrubbed of any geographical limitations. Their inclusions list was changed to add the phrase ...

(Update: Walmart’s new automated low price guarantee appears to be nationwide now. While still in “beta”, their FAQ has been scrubbed of any geographical limitations. Their inclusions list was changed to add the phrase ... -

Monday, July 28, 2014 from BargaineeringRuss Heaps Most of us like to tell “fish stories,” and they often include tales about the great deal we negotiated on our new car or truck. But behind closed doors, many of us obsess that we really paid too much. At least that’s th...

-

Monday, July 28, 2014 from Personal finance and money news, analysis and comment | theguardian.comAnalysis of Student Loan Company figures shows overall student debt rising far more sharply in Scotland than elsewhere in UK Continue reading...

-

Monday, July 28, 2014 from Personal finance and money news, analysis and comment | theguardian.comRAC charged £193 to get me off the motorway when my fan belt broke Continue reading...

-

Monday, July 28, 2014 from Personal finance and money news, analysis and comment | theguardian.comDuring the summer, smart restaurant owners put cunning tactics on the menu to boost profits Continue reading...

-

Monday, July 28, 2014 from Personal finance and money news, analysis and comment | theguardian.comProsective employers contact my former company, which makes negative remarks. I'm not coping and feel depressed Continue reading...

-

Monday, July 28, 2014 from MarketWatch.com - Personal Finance NewsEconomic risks are rising in Europe, and ECB President Mario Draghi is short on tools, and time, writes Satyajit Das

-

Monday, July 28, 2014 from Personal finance and money news, analysis and comment | theguardian.comHalifax identifies a sharp drop in the number of people who feel that it would be a good time to buy a house over the next 12 months Continue reading...

-

Monday, July 28, 2014 from Personal Finance AdviceWhether you’re a waiter, a librarian or a taxi driver, having a bad memory can make life rather unmanageable. But this week, researchers from the University of Michigan and the University of California, Irvine have published resear...

-

Monday, July 28, 2014 from Everybody Loves Your Money

How much money do you need to earn to feel successful? Fifty thousand a year? One hundred thousand? Two hundred thousand? What’s the magic number? A recent Harris Poll study attempted to unveil the answer. Right around 5,500 men and wome...

How much money do you need to earn to feel successful? Fifty thousand a year? One hundred thousand? Two hundred thousand? What’s the magic number? A recent Harris Poll study attempted to unveil the answer. Right around 5,500 men and wome... -

Monday, July 28, 2014 from NYT > Your MoneyThe inflation-adjusted net worth for the typical household fell 36 percent in the 10 years ended in 2013, according to a study.

-

Sunday, July 27, 2014 from Kiplinger's Personal FinanceIt's good to see a long-term stock market bear concede that stocks are not overpriced.

-

Sunday, July 27, 2014 from Quizzle Wire

They became adults in the midst of the Great Recession, just old enough to watch their parents freak out about... The post Millennials might be selling themselves short with cash appeared first on Quizzle Wire .

They became adults in the midst of the Great Recession, just old enough to watch their parents freak out about... The post Millennials might be selling themselves short with cash appeared first on Quizzle Wire . -

Sunday, July 27, 2014 from Personal Finance AdviceFaulty airbags have caused the recall of millions of cars over the past year. Another quarter of a million can be added to the list as Nissan has decided to recall 226,326 more of their vehicles due to the issue. … Continue reading...

-

Sunday, July 27, 2014 from ConsumerAffairs News: Personal Finance NewsMost U.S. households haven't recovered lost net worth By Mark Huffman of ConsumerAffairs July 28, 2014 © iQoncept - Fotolia.com If you're feeling poorer these days, maybe you are. A recent study from the Russell Sage Foundation ...

-

Sunday, July 27, 2014 from Forbes - Personal FinanceDespite President Obama's Claim That Going Offshore Is Unpatriotic, Inverison Deals Are the Talk of Boards, Investors and Funds.

-

Sunday, July 27, 2014 from Personal finance and money news, analysis and comment | theguardian.comMammoth companies are trying to collect water that all life needs and charge for it as they would for other natural resources Continue reading...

-

Sunday, July 27, 2014 from Don't Mess With Taxes$16 million. That's how much in tax breaks CBS is eligible for by keeping The Late Show in the Big Apple. The bulk of the money is $11 million in tax credits over five years. Then there's another $5 million in grants from Empire State De...

-

Sunday, July 27, 2014 from SmartAsset BlogWhen it comes to getting ahead financially in today’s economy, millennials are presented with some unique challenges. These newly minted college grads often face an uphill climb when it comes to finding their footing in the workpla...

-

Sunday, July 27, 2014 from Quizzle Wire

DR 091: Don’t Make the Same $100,000 Retirement Mistake I Just Made So what’s the $100,000 mistake? Based on my... The post Quizzle Top 5 Weekly Must-Reads – July 27, 2014 appeared first on Quizzle Wire .

DR 091: Don’t Make the Same $100,000 Retirement Mistake I Just Made So what’s the $100,000 mistake? Based on my... The post Quizzle Top 5 Weekly Must-Reads – July 27, 2014 appeared first on Quizzle Wire . -

Sunday, July 27, 2014 from MarketWatch.com - Personal Finance NewsGlobally, cigarette smoking prevalence is flat or decreasing, but the total number of smokers world-wide continues to increase simply due to population growth. In the wake of the $23 billion jury verdict against Reynolds American and tha...

-

Sunday, July 27, 2014 from MarketWatch.com - Personal Finance NewsThe tech giant has good reason to worry about the impact of introducing a bigger version of the iPhone, tech analysts say.

-

Sunday, July 27, 2014 from MarketWatch.com - Personal Finance NewsThis wine scammer could face decades in jail.

- These cities won’t be adding these dubious honors to their tourism brochures.

- Bitcoin and other virtual currencies can be volatile and fraud-prone, but you may still wind up using one soon.

-

Sunday, July 27, 2014 from Your MoneyHow meaningful and trustworthy are seals of approval from the likes of Energy Star and Good Housekeeping? NPR's Arun Rath speaks with advertising expert Lucy Atkinson about their validity.

-

Sunday, July 27, 2014 from TORONTO STAR | BUSINESS | PERSONAL_FINANCEKawarthas or Muskoka, if you’re serious about taking the cottage plunge, take a hard look at what it will really cost to be a cottager

-

Sunday, July 27, 2014 from Forbes - Personal FinanceIt’s a staple of the investment press: The “top funds” list. You see them on magazine covers and online, and they dazzle us with the potential for market-beating gains. Here’s a dirty little secret. The lists change all the time. It’s ex...

-

Sunday, July 27, 2014 from Forbes - Personal FinanceYou work hard, you try to save. Why does retirement seem so out of reach? The problem is psychological. You probably save more than most, but do you know it’s enough? You also probably have a good idea of what you need to retire, but are...

-

Sunday, July 27, 2014 from Forbes - Personal FinanceIt takes money to make money,” or so the saying goes. In lottery states, the advertising often sounds like this: “You can’t win if you don’t play.” Both are common-sense statements, and both are horribly wrong when it comes to retirement...

-

Sunday, July 27, 2014 from Daily Express :: Personal Finance FeedAS AIRPORTS in the UK enter their busy season this weekend, they will be expecting their tills to be going into overdrive.